Pipeline stocks have emerged as the unexpected stars of the surging energy sector in recent weeks. While companies like Nvidia (NVDA: NSD) were previously seen as the clear beneficiaries of the AI boom due to their essential microchip technology, a less obvious, yet crucial, element of the AI revolution is finally gaining investor attention: gas pipelines.

Pipeline Plays Return from the Doldrums:

For years, pipeline infrastructure stocks languished, largely ignored by investors. However, the rise of AI is translating into good news for gas pipeline companies. These companies are seeing a resurgence in interest, with leading players like Kinder Morgan (KMI: NYE) experiencing record-breaking winning streaks. Kinder Morgan’s stock price, for example, has risen over 5% in the past month alone. Other pipeline operators, such as Williams Companies (WMB: NYE), are witnessing similar positive trends.

Why AI Needs Gas Pipelines:

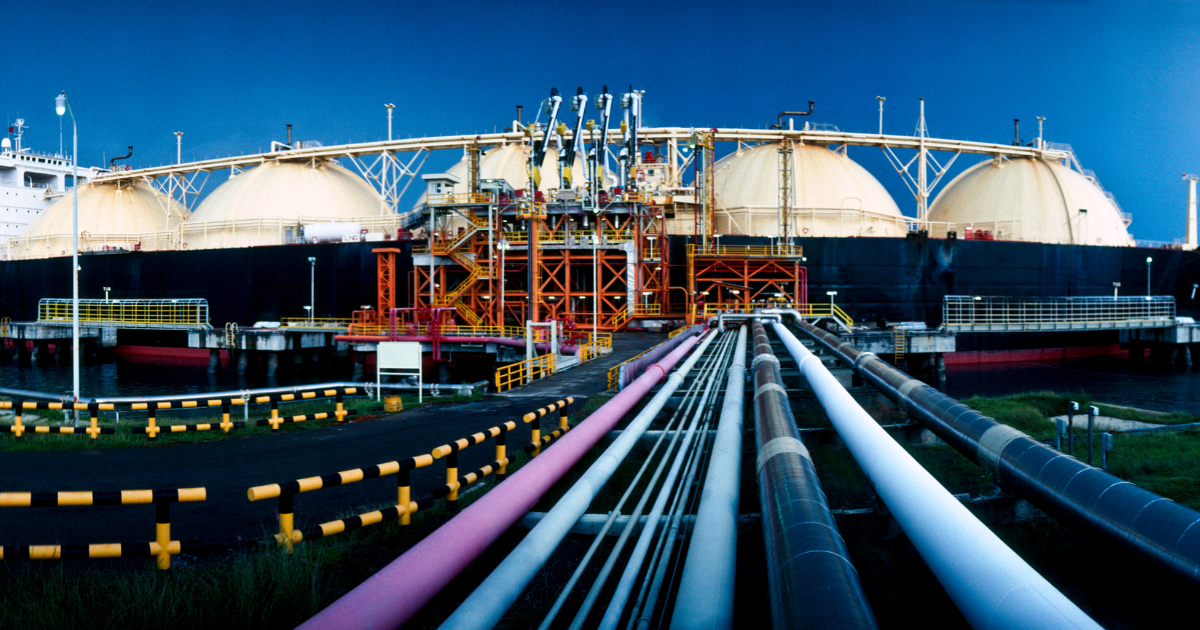

One might wonder why AI, a seemingly high-tech field, would require something as traditional as gas pipelines. The answer lies in the immense computational power required to train and run complex AI algorithms. These algorithms rely on massive data centers that consume vast amounts of energy. Natural gas is a reliable and efficient source of energy for these data centers, making gas pipelines a critical component of the AI infrastructure.

Investment Opportunities in a Changing Landscape:

The unexpected connection between AI and gas pipelines presents new investment opportunities for those looking to capitalize on the ongoing technological revolution. While traditional energy companies like oil producers and refiners might not be the most direct beneficiaries of AI, pipeline stocks offer a unique way to gain exposure to this transformative trend.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.