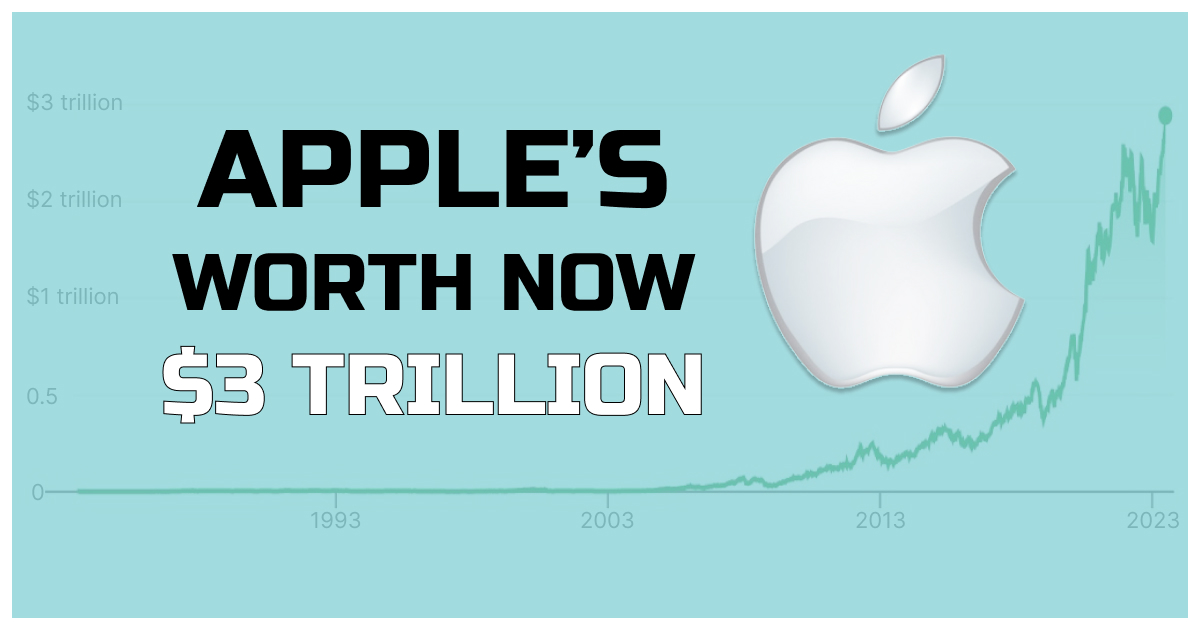

Apple Inc. has achieved a significant milestone, becoming the first company in the world to reach a staggering valuation of $3 trillion. The tech giant’s stock has witnessed a remarkable 55% growth over the past six months, fueled by its expansion into new markets and the Federal Reserve’s cautious approach to interest rate hikes.

Unparalleled Technology and Profitability

Apple’s continuous innovation, exemplified by groundbreaking products like the Apple Vision Pro, coupled with exceeding profit expectations, has made the company a favorite among investors. The recent quarterly profit report showcased Apple’s consistent earnings and a solid track record of stock buybacks, solidifying its reputation as a safe investment even during periods of economic uncertainty.

Tech Industry Surge

Apple’s achievement comes at a time when other major technology companies are also experiencing significant surges in their stock prices. Microsoft, the second most valuable company after Apple, boasts a market valuation of $2.53 trillion and has witnessed a 42% growth over the past six months. Google, a direct competitor in the mobile phone market, has grown by over 34% during the same period. Additionally, chip maker NVIDIA‘s remarkable growth of over 195% in the past six months has propelled it into the exclusive $1 trillion club.

Artificial Intelligence Drives Growth

The technology industry’s recent surge can largely be attributed to the emergence of artificial intelligence (AI), which has sparked intense competition among major tech firms. While Google, Microsoft, and NVIDIA heavily invest in AI, Apple has displayed limited interest in the technology. Although Apple plans to incorporate AI into its future devices, the company remains cautious about its utilization.

Tech Giants Flourish, Tesla Rises

Apple’s extraordinary achievement is part of a broader trend, with other tech giants also experiencing significant market capitalization growth. Electric car manufacturer Tesla witnessed a remarkable 28% increase in its market capitalization in June, driven by deals made by competitors Ford Motor Co and General Motors Co to access Tesla‘s charging network.

NVIDIA and Microsoft Join the Elite

Joining Apple in the race for valuation supremacy, NVIDIA reached the $1 trillion valuation mark, benefiting from investor optimism surrounding the AI boom. The company’s shares surged following a revenue forecast that exceeded Wall Street’s expectations by over 50% in May. Meanwhile, Microsoft stood alongside Apple as one of the top 20 global companies by market capitalization at the end of June.

Alphabet Faces Challenges

In contrast to its peers, Alphabet Inc., the parent company of Google, experienced a 2.3% drop in market capitalization last month, amounting to $1.53 trillion. Rising competitive pressures from Microsoft’s Bing, which integrated the AI technology behind ChatGPT, have posed challenges to Alphabet’s market position.

Conclusion

Apple’s historic achievement of reaching a $3 trillion valuation signifies its status as a tech powerhouse. The company’s consistent profitability, innovative product offerings, and strong track record of stock buybacks have attracted investor confidence, solidifying its position as a safe investment even in times of economic uncertainty. As the technology industry continues to thrive, driven by advancements in artificial intelligence, companies like Apple, Microsoft, and NVIDIA are poised to dominate the global market, shaping the future of technology.

STA Research (StockTargetAdvisor.com) is a independent Investment Research company that specializes in stock forecasting and analysis with integrated AI, based on our platform stocktargetadvisor.com, EST 2007.