Investing in the stock market requires careful analysis and constant vigilance. For busy investors, keeping track of multiple stocks, financial reports, and market trends can be overwhelming. The traditional methods of financial reporting—digging through spreadsheets and manual analysis—are time-consuming and prone to error. Fortunately, automated financial reporting is revolutionizing the investment landscape, offering tools that save time, enhance accuracy, and ensure real-time market updates.

In this article, we’ll explore how automated financial reporting can streamline investment management, helping investors make more informed decisions while optimizing their time and resources.

1. Save Time with Instant Reports:

Automated financial reporting gives investors the power to quickly access detailed reports without the hassle of manual data entry and analysis.

Elimination of Manual Work:

One of the greatest advantages of automated financial reporting is the ability to generate comprehensive reports in an instant. Traditional methods often require investors to manually gather, organize, and analyze data, which can take hours or even days. Automated tools, however, compile all relevant financial data in just a few clicks, offering detailed insights into stock performance.

Downloadable Premium Reports:

Stock Target Advisor automated reporting systems have a feature called Download Premium Report that lets investors get in-depth analysis on the stocks they have chosen. These real-time reports give you a lot of information about a stock’s market position and financial success. Investors can use this tool to stay up-to-date and make sure their choices are based on the most recent market data and trends.

Efficiency for Busy Investors:

Imagine juggling multiple stocks, each with its own set of financials and market performance data. Automated reporting allows investors to manage and analyze large portfolios without the hassle of manual labor. This system delivers comprehensive insights instantly, making it easier for investors to track the financial health of their stocks and portfolios efficiently.

2. Boost Accuracy with AI Insights:

In the fast-paced world of investing, accuracy is everything. Even the slightest error can lead to missed opportunities or costly mistakes. That’s where AI-powered tools come into play, offering precision that manual methods simply can’t match.

Investing is all about making informed decisions, and now you can do it for less. Get 70% off Stock Target Advisor and start optimizing your portfolio today. Claim your discount here!

AI-Powered Data Analysis:

One of the biggest risks in manual financial reporting is human error. Even the slightest miscalculation can result in flawed reports, leading to misguided investment decisions. Automated financial reporting systems, powered by artificial intelligence (AI), eliminate these risks. AI-based reporting tools process vast amounts of data with incredible precision, ensuring that investors receive error-free reports based on data-driven insights.

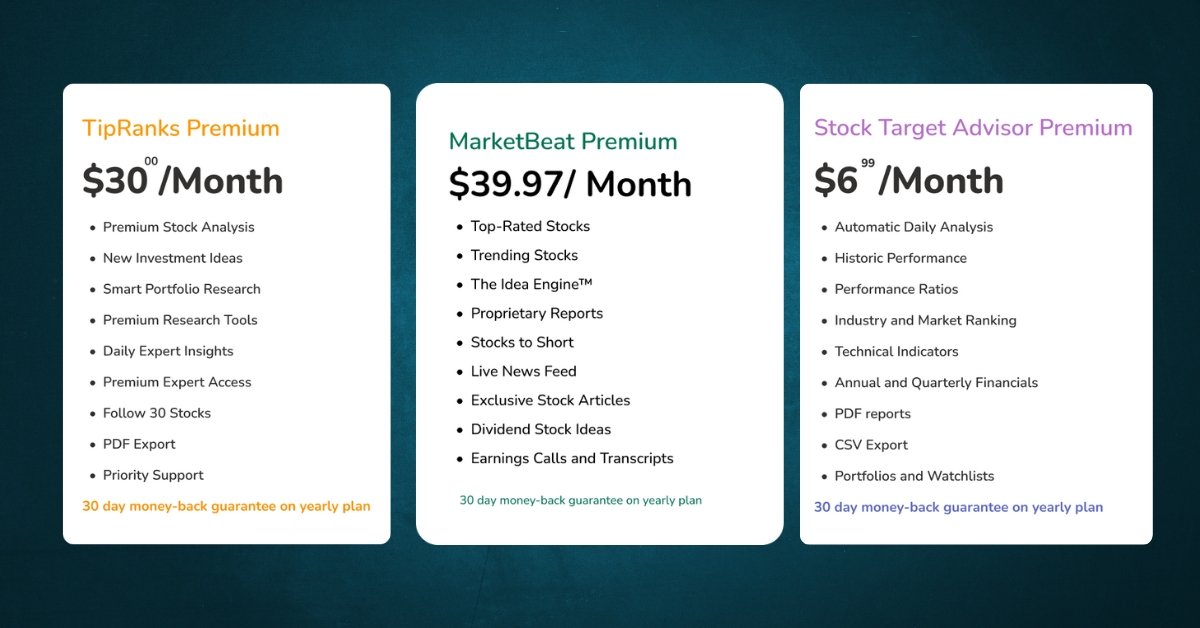

Read More: Stock Target Advisor vs Other leading platforms

Confidence in Decision Making:

The accuracy provided by AI-generated reports instills confidence in investors. By eliminating the possibility of errors in data collection and interpretation, investors can trust the information they receive, allowing them to make well-informed, strategic decisions. Whether analyzing stock trends or assessing financial metrics, investors can rely on the accuracy and precision that AI-powered tools deliver.

One of the standout features of automated reporting tools is the integration of Stock Target Advisor analysis, which provides a professional evaluation of the stock’s prospects. Combined with expert opinions and user ratings, this feature offers a well-rounded perspective, ensuring investors can make informed choices based on a variety of inputs.

3. Stay Updated in Real-Time:

Automated financial reporting ensures that investors receive the most current information, allowing them to make timely and well-informed decisions without having to constantly monitor the markets.

Up-to-the-Minute Data:

The stock market moves quickly, and opportunities can arise—or disappear—in seconds. Staying updated with real-time data is crucial for making timely investment decisions. Automated financial reporting tools ensure that investors are always aware of the latest market movements. With access to real-time data, investors can react swiftly to changes in stock performance or market conditions, seizing opportunities as they arise.

Seamless Integration with Strategy:

Real-time data is only valuable if it can be integrated into an investor’s overall strategy. Automated tools not only provide up-to-date information but also offer features that allow investors to instantly adjust their portfolios or strategies based on the latest data. By combining real-time updates with powerful reporting tools, investors can make dynamic, informed decisions that align with their long-term goals.

Detailed Reports at Your Fingertips:

Automated platforms not only provide real-time data but also offer detailed financial reports that cover key metrics like closing prices, price changes, market capitalization, and trading volume. This comprehensive reporting ensures that investors have a clear and accurate view of a stock’s performance at any given time.

Conclusion:

Automated financial reporting offers busy investors a powerful toolset for managing their portfolios more efficiently. Whether you’re a seasoned trader or a casual investor, embracing automation can enhance your investment strategy, helping you stay ahead in a fast-moving market.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.