Hertz Global Holdings (HTZ: NSD) is grappling with rising costs and is looking to raise capital through various financing options, according to a Bloomberg report. This move comes as the car rental company strives to improve its financial health and liquidity.

Failed Electric Vehicle Bet Weighs Heavy:

Hertz’s recent woes can partly be attributed to its unsuccessful foray into the electric vehicle (EV) market. The company’s heavy investment in Tesla’s backfired, leading to significant losses. To rectify this, Hertz is now shifting its focus back to gasoline-powered vehicles.

Debt Burden and Analyst Outlook:

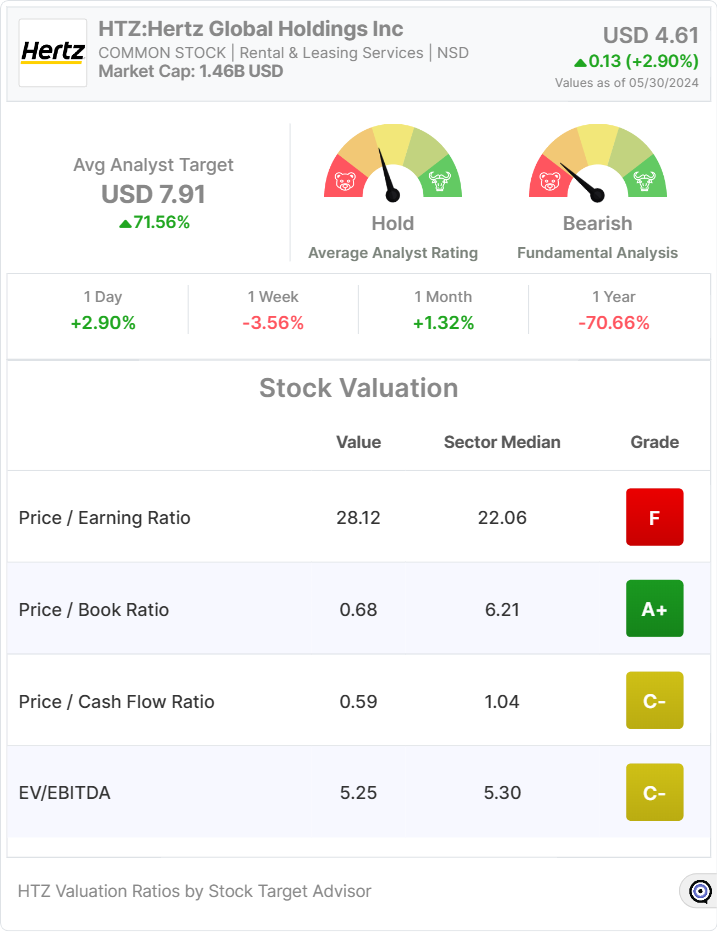

Hertz is currently carrying a hefty net corporate debt of $3.25 billion, exceeding its long-term leverage target. This financial strain, coupled with weak earnings, prompted Moody’s Ratings to downgrade its outlook on Hertz to negative from stable. Analyst sentiment also remains bearish, with a “Moderate Sell” consensus rating and a price target suggesting limited upside potential for HTZ stock.

Bottom Line:

It’s unclear whether Hertz will pursue issuing new equity, taking on more debt, or a combination of both. However, one thing is certain: the company needs a financial boost to navigate these challenging times and stay afloat.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.