As an investor, you might be wondering how many shares of a particular stock you should buy to make a profit. The answer to this question is not merely a number but a strategic decision influenced by several factors. Here we will discuss position sizing as well as the factors that influence how many shares to buy.

Furthermore, we also explore the role of fractional shares in creating profitable investment opportunities and the strategies inspired by legendary investor Warren Buffett.

Consideration Before Making Any Investment:

Two crucial steps must be addressed before exploring investment options: having an emergency fund and defining your financial goals.

Step 1: Build Your Safety Net

Establishing an emergency fund is essential before embarking on any investment journey. This fund should cover 6-12 months of living expenses and serve as a safety net in case of unforeseen circumstances such as job loss or medical emergencies. By having an emergency fund, you gain financial security and peace of mind.

Step 2: Define Your Financial Goals

Now that you have your emergency fund in place, it’s time to align your investment strategy with your financial goals. Consider the following questions:

- Assess your level of involvement. Determine the balance between passive and active investments that suit your lifestyle.

- Evaluate your risk tolerance. How much are you comfortable potentially losing?

- Consider the timeline for accessing the invested money. Will you need the funds soon or is this for long-term growth?

Position Sizing and Its Significance in Portfolio Management:

Position sizing is the process of determining how much capital to allocate to a particular investment. It is an essential aspect of portfolio management as it helps investors manage their risk and maximize their returns. By determining the appropriate position size, investors can ensure that they are not overexposing themselves to a particular investment or underutilizing their capital.

Read More: How to Invest $100k for Passive Income

Factors Influencing How Many Shares One Should Buy:

There are several factors to consider when determining how many shares of a particular stock to buy. These factors include investment capital, portfolio fit, risk tolerance, and investment goals.

1. Investment Capital:

The amount of investment capital you have available will influence how many shares you can afford to buy. Generally, it is recommended that investors do not allocate more than 2% to 5% of their portfolio to any single stock. For example, if you have $10,000 to invest, you should not invest more than $200 to $500 into a single stock.

2. Portfolio Fit:

The suitability of a particular stock for your portfolio is another factor to consider. For example, if you are an aggressive investor, you may consider buying more shares of a high-growth stock. If you are a conservative investor, you may opt for a lower-risk stock with a stable dividend payment.

3. Risk Tolerance:

Another factor to consider is your risk tolerance. If you are comfortable with taking on more risk, you may be willing to invest in riskier assets, including stocks with higher volatility. However, if you are risk-averse, you may prefer to invest in more stable stocks with lower volatility.

The Role of Fractional Shares in Investment:

Fractional shares have emerged as a democratizing force in the stock market, allowing individuals to invest in partial units of a company’s stock. This accessibility has empowered retail investors to embrace a more diversified investment portfolio.

Highlighting how fractional shares can allow small investors to diversify their portfolios like Warren Buffett. By having access to fractional shares, investors can create diversified positions across various industries, mirroring the strategy of renowned investors.

Read More: Top Investment Trends for 2024

Warren Buffett’s Investment Diversification:

Diversification is not about having a lot of shares but having shares in a lot of different sectors. This is key to mitigating risk. Following the wisdom of Buffett, you might have a mix of tech giants, consumer goods, and financial institutions in your portfolio, each with its own weighting based on your confidence in their performance.

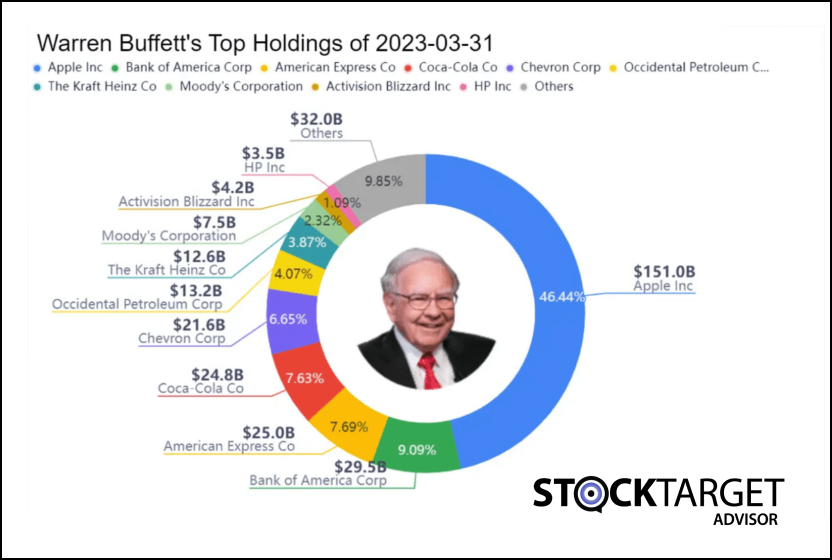

The iconic investor’s portfolio, as of the first quarter of 2023, was a testament to smart diversification. A staggering 46.44% of his holdings were in Apple Inc (AAPL: NSD). While it may seem counterintuitive to the principle of not putting all your eggs in one basket, Buffett’s choice reflects a deep trust in Apple’s long-term value. His other significant investments included financial giants like Bank of America Corp and consumer staples such as Coca-Cola Co.

Buffett’s approach underlines the importance of investing in companies you believe in, ones with a solid business model and a competitive edge in their industry. It’s not about the quantity but the quality and future potential of the shares you hold.

The Impact of Time Horizon on Investment:

The investment timeline is determined by the length of time an investor is willing to hold onto their stock investments. A longer investment horizon allows investors to ride out market volatility, withstand temporary downturns, and reap the benefits of compounding returns over time. On the other hand, a shorter investment timeline puts investors at greater risk of losing money due to market fluctuations.

1. Making Informed Investment Decisions:

Therefore, to make informed investment decisions, it’s important to consider your investment timeline carefully. This can help you determine the number of shares you need to purchase in order to generate the desired profit within your desired investment horizon. In other words, if you have a long-term investment horizon, you may not need to purchase a large number of shares to achieve a significant return on investment.

2. Embracing Long-Term Investment Philosophy:

Long-term investing philosophy is strongly advocated by the legendary investor, Warren Buffett. By focusing on the long-term health and profitability of a company, investors can take advantage of the power of compounding returns and build significant wealth over time. Emulating Buffett’s investment approach can help investors make informed decisions and achieve profitability in the stock market.

Tips to Stay Informed and Adapt to Market Changes:

View the world of investing as a journey full of surprises and unexpected twists. Your survival kit on how to invest is as below:

- Stay Informed: Treat financial news as your treasure map, guiding you to the hidden riches of market trends. Keep a keen eye on reliable sources to stay ahead of the curve.

- Diversify Your Portfolio: Diversify your investments across various sectors. A diversified portfolio can help mitigate losses.

- Set Realistic Expectations: The market can be as unpredictable as the weather but do not let passing storms rattle you. Focus on the long term and adhere to your investment plan.

- Regularly Review and Adjust: Think of your investments as a continuously evolving landscape. Regularly review and adjust them as your goals change.

- Seek Guidance: Much like an explorer relies on a map, consulting a financial counselor can help you navigate the intricate world of investments. They will offer guidance tailored to your goals and circumstances.

Conclusion:

Finding the exact number of shares to buy is an art that balances financial goals, market understanding, and risk tolerance. Learning from investment gurus like Warren Buffett and adapting their principles to fit your individual strategy can pave the way to profitability.

Remember when it comes to investing in the stock market, there is no one-size-fits-all strategy, but careful consideration and a solid plan can help you navigate the path to success.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.