Investing in emerging technologies and companies has always been attractive to people interested in supporting innovation and maximizing opportunity. Anthropic is one such company that has attracted significant attention in the artificial intelligence industry.

Although Anthropic is not currently available for direct investment, there are alternative ways of participating in the AI revolution sparked by Anthropic despite this limitation. In this article, we will explore the steps to invest in Anthropic and the alternative options available to interested investors.

Anthropic Overview:

Anthropic is an AI research and safety company that was founded in 2021 and is headquartered in San Francisco, US. Their flagship product, Claude, has gained recognition for its natural language processing capabilities and has secured investments from major players in the field. Anthropic’s mission is to build intelligent systems that benefit humanity and enhance interactions between humans and AI.

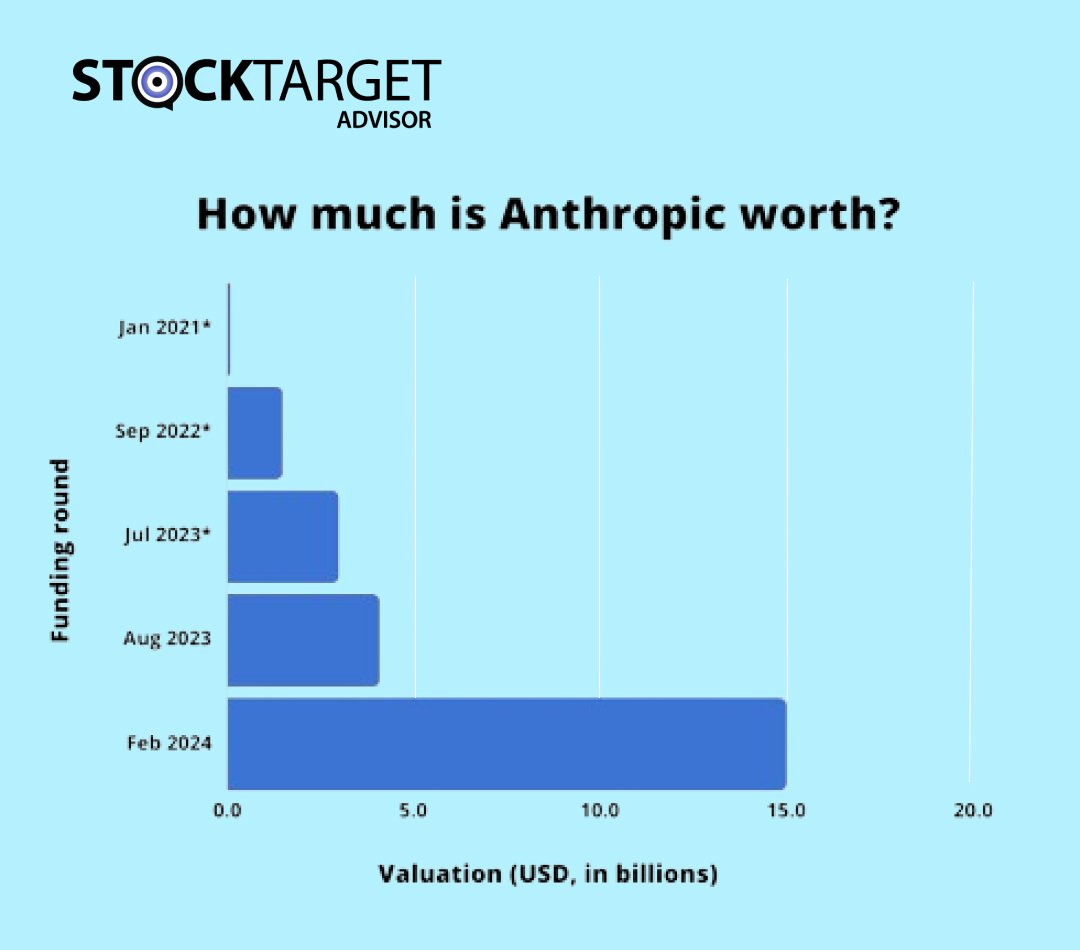

Amazon recently announced that it would invest $4 billion in Anthropic, making it a significant development in their journey. The investment will take place in two phases, further solidifying the company’s worth. But that’s not all. In late 2022, Google also invested $300 million in Anthropic, acquiring a 10% stake. This demonstrates the industry’s recognition of the company’s potential and promising future.

Additionally, other notable investors include Spark Capital, Salesforce, Sound Ventures, Menlo Ventures, and Zoom.

How to Buy Anthropic Stock:

Anthropic is currently not publicly traded, so it is important to note before diving into the specifics of purchasing its stock. Anthropic’s stock is available to accredited investors only through private investment opportunities, rather than through traditional stock exchanges.

To invest in Anthropic stock directly, one must be classified as an accredited investor, meeting certain financial criteria. Accredited investors typically have a high net worth and the necessary capital to invest in private companies. However, even accredited investors may not have access to invest in Anthropic directly at this stage.

Ready to make informed investment decisions? Watch our in-depth analysis Video on Anthropic!

Invest in Anthropic’s Partners:

You can indirectly invest in Anthropic through different alternatives, even though most people can’t afford to invest directly in the company. One such option is to invest in companies that have partnered with Anthropic.

1. Amazon Inc. (AMZN: NSD):

Investing in Amazon means investing in everything else that the company does. Nevertheless, given the good ratings and the stock’s trajectory, it might still be a viable option. Amazon’s partnership with Anthropic signifies not only financial support but also strategic collaboration that has the potential to pave the way for Anthropic’s success in the AI market.

2. Alphabet Inc. (GOOG: NSD):

Aside from Amazon, other big-name investors that also happen to be public companies like Google (GOOGL: NSD), Salesforce (CRM: NYE), and Zoom (ZM: NSD) present an opportunity to invest indirectly in Anthropic’s growth. Anthropic partnerships with these companies not only offer financial support but also strategic collaborations that could contribute to Anthropic’s potential success in the AI market. Investing in these companies could give you an indirect piece of the action with Anthropic.

How does Anthropic Generate Revenue?

To evaluate investment prospects, it is important to understand how Anthropic generates revenue. Following are the revenue streams of Anthropic.

1. Offering Commercial Applications of AI Technology:

One key aspect of Anthropic’s revenue model is offering commercial applications of their AI technology. This includes licensing their advanced chatbot models to other companies, which enables these companies to integrate Anthropic’s cutting-edge AI solutions into their own applications.

Read More: How to Buy Valve Stock?

2. Forming Partnerships for AI Solutions:

In addition to offering commercial applications of their AI technology, Anthropic also focuses on forming strategic partnerships with companies looking to enhance their products or services through AI solutions. By collaborating with these businesses, Anthropic helps them leverage the power of AI technology to improve their offerings and stay ahead in their respective industries.

Major Competitors of Anthropic:

Anthropic faces competition from several companies in the AI industry, each with its unique approaches and innovations. Here are the main competitors of Anthropic.

1. ChatGPT:

ChatGPT is an AI chatbot platform founded by OpenAI. Microsoft Corporation (MSFT: NSD) has a significant stake in OpenAI. In early 2023, Microsoft announced a substantial multiyear investment with OpenAI, rumored to be in the range of $10 billion. According to OpenAI CEO Sam Altman, 100 million people utilize ChatGPT each week.

Read More: How to Buy OpenAI Stock?

2. Gemini:

Gemini is Google’s most capable AI model in the evolving AI field. Their steadfast dedication is directed towards the development of decentralized artificial intelligence systems. Gemini distinguishes itself from the mainstream by using blockchain technology to create AI solutions that value openness, security, and resilience.

Conclusion:

Investing in Anthropic stock directly may not be feasible for individual investors, as it is not publicly traded. However, exploring alternative avenues such as investing in Anthropic’s partners or monitoring industry developments can provide opportunities to indirectly benefit from Anthropic’s growth.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.