Investing in popular and innovative companies before they go public can be a lucrative opportunity. OnlyFans, known for its subscription-based content platform, has garnered significant attention from investors due to its unique business model and substantial market potential. However, purchasing OnlyFans stock involves navigating through private markets and indirect investment strategies. In this article, we will guide you through the steps to buy OnlyFans stock, explore alternative investment options, and understand its business dynamics and competitors.

OnlyFans: Company Overview

OnlyFans is operated by Fenix International Limited, primarily owned by Leonidas Radvinsky. The platform allows content creators to earn money from subscribers, offering a range of content from fitness tutorials to more adult-oriented material. Despite its popularity, the controversial nature of its content has deterred major investors, making OnlyFans a unique entity in the investment landscape.

In 2020, OnlyFans’ revenue was reported to be $380 million, which skyrocketed to $1.2 billion in 2021. A significant spike in the platform’s volume occurred after Beyoncé mentioned OnlyFans in a Megan Thee Stallion song remix, resulting in a 15% increase. Around this time, founder Tim Stokely claimed that the site saw about 200,000 new users and 7,000-8,000 creators joining daily. The platform is said to pay more than $200 million per month to creators and, unlike many tech companies, is profitable. Estimates indicate that as of 2022, OnlyFans had about 1,000 employees.

How to Buy OnlyFans Stock?

As of now, OnlyFans has not announced an initial public offering (IPO). This means direct investment in OnlyFans stock is not currently possible for retail investors. However, you can prepare for a potential IPO by:

Opening a Brokerage Account: Select a brokerage that offers access to IPOs and stay updated on financial news regarding OnlyFans.

Participating in Pre-IPO Markets: Accredited investors can explore platforms like EquityZen or Forge Global to invest in pre-IPO shares.

Monitoring IPO Announcements: Keep an eye on financial news and press releases from OnlyFans for any updates on their IPO plans.

Invest in OnlyFans’s Partners and Investors:

Investing in companies that have strong partnerships or financial ties with OnlyFans can provide indirect exposure to its growth. Here are a few notable options:

1. Anheuser Busch:

Anheuser Busch, a leading beverage company, has shown interest in diversifying its investment portfolio. Though its connection with OnlyFans might seem unconventional, the company’s progressive investment strategies can make it a beneficiary of OnlyFans’ innovative revenue model. Investing in Anheuser Busch could offer stability and growth potential linked to OnlyFans’ market dynamics.

2. RCI Hospitality Holdings:

RCI Hospitality Holdings operates nightclubs and bars across the United States, positioning itself well within the entertainment and adult entertainment industries. Given the overlapping audience and market strategies, RCI’s business growth could mirror the trends seen in OnlyFans’ user engagement and financial performance, making it a viable investment option.

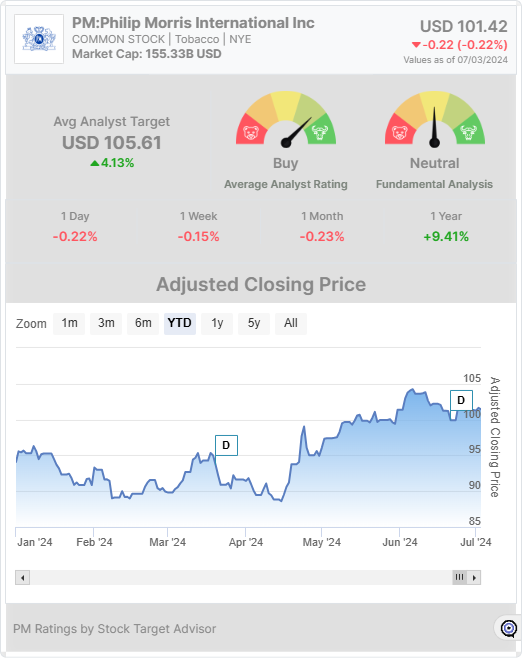

3. Philip Morris International:

Philip Morris International, primarily known for its tobacco products, has been investing in various sectors to mitigate risks associated with its core business. While its direct ties to OnlyFans might not be apparent, Philip Morris’s investment strategy includes high-yield and high-growth sectors, aligning well with the type of market OnlyFans operates in.

How Does OnlyFans Generate Revenue?

OnlyFans’ revenue model is multifaceted, primarily driven by:

Subscription Fees: Creators charge subscribers a monthly fee, and OnlyFans takes a percentage of this fee.

Pay-Per-View Content: Creators can offer exclusive content for an additional fee, with a portion going to OnlyFans.

Tips and Donations: Fans can tip their favorite creators, providing another revenue stream for the platform.

These diverse revenue channels have allowed OnlyFans to maintain robust financial health and attract a large user base.

Major Competitors of OnlyFans:

OnlyFans is currently considered the leader in the adult content industry, but it has major competitors such as Playboy and Patreon.

1. Playboy Inc:

Playboy has transformed from a traditional print publication to a digital content platform. Its subscription-based model for exclusive content directly competes with OnlyFans. Playboy’s extensive brand recognition and diversified content portfolio make it a significant competitor in the digital subscription market.

2. Patreon Inc:

Patreon offers a similar subscription service where fans support creators through monthly pledges. While Patreon is more generalized and less focused on adult content, it competes with OnlyFans in the broader creator economy. Patreon’s user-friendly platform and flexible content policies provide a strong alternative for creators seeking diversified revenue streams.

Conclusion:

Investing in OnlyFans before its IPO might be challenging but not impossible. By exploring private equity opportunities, secondary marketplaces, and investing in OnlyFans’ partners and investors, potential investors can position themselves to benefit from OnlyFans’ growth. As the company navigates its unique market position, staying informed and strategic will be key to capitalizing on this innovative platform’s financial success.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.