The autonomous vehicle (AV) sector is a rapidly growing industry with significant potential for expansion. A study conducted by Global Nissan News found that 55% of small business owners anticipate operating fully autonomous vehicle fleets within the next two decades, indicating that the field is growing rapidly.

Waymo is one of the most promising self-driving car projects in the world. However, Waymo is not currently available for direct investment, there are alternative ways of participating in the AV revolution sparked by Waymo despite this limitation.

In this article, we will explore the steps to invest in Waymo and the alternative options available to interested investors.

Waymo: Company Overview

Waymo, formerly known as the Google Self-Driving Car Project, is a groundbreaking self-driving car initiative established by Alphabet Inc (GOOGL: NSD) in 2009. Its mission is to make transportation safe and easy. Waymo has a proven record of accomplishments in the real world and simulated driving experience. It has driven more than 20 billion miles, and its technology is operational.

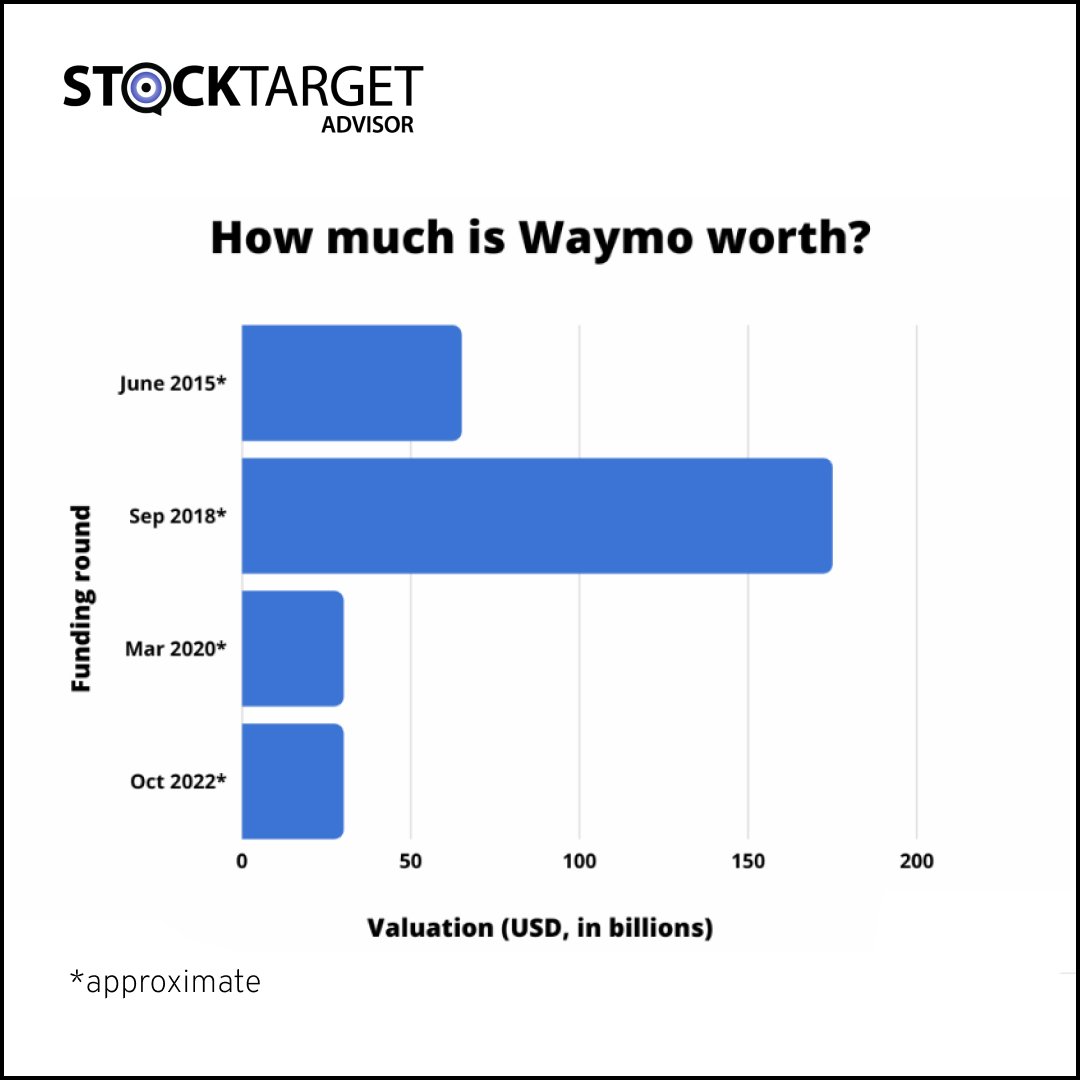

Waymo was founded in 2009 and later rebranded under the same name in 2016, gaining recognition as a leading self-driving technology company. In March 2020, Waymo’s valuation was adjusted to $30 billion from its peak of $175 billion in November 2019. This adjustment was primarily attributed to the prolonged development timeline for the commercialized product.

However, the recent successes of Waymo’s operations in cities like San Francisco and Phoenix have dispelled many concerns, instilling confidence in the company’s future prospects. Consequently, it is expected that future funding rounds will likely be raised at significantly higher valuations.

How to Buy Waymo Stock:

Waymo is a private company and has not publicly announced any plans to IPO in the near future. Therefore, buying Waymo stock directly is not an option for the general public. Only accredited investors can invest in Waymo through the Hiive platform. However, retail investors can invest indirectly in Waymo by investing in Alphabet, its parent company.

Ready to make informed investment decisions? Watch our in-depth analysis Video on Waymo Stock.

Invest in Waymo’s Investors and Partners:

You can indirectly invest in Waymo through different alternatives, even though most people can’t afford to invest directly in the company. One such option is to invest in companies that have invested and partnered with Waymo.

1. Alphabet Inc. (GOOGL: NSD):

Alphabet is Waymo’s parent company and also its most significant investor. Alphabet owns around 82% of Waymo, and if Waymo becomes a dominant player in the autonomous vehicle industry, it could become an increasingly important part of Alphabet’s conglomerate. For retail investors looking to invest in Waymo, investing in Alphabet (GOOGL: NSD) is the most obvious route.

2. AutoNation Inc. (AN: NYE):

AutoNation is the 2nd largest investor of Waymo. It has participated in two of Waymo’s funding rounds, though the exact amount of AutoNation’s stake in the autonomous vehicle project is unknown, it’s likely a few hundred million. In addition to its investment in Waymo, AutoNation has partnered with the company in a venture that sees Waymo’s vehicles delivering parts to AutoNation locations and other repair shops in Arizona.

Waymo also has partnerships with multiple vehicle manufacturers and ride-hailing companies, including.

- Stellantis NV (STLA: NYE)

- Lyft Inc (LYFT: NSD)

- Uber Technologies Inc (UBER: NYE)

- Intel Corporation (INTC: NSD)

How does Waymo Generate Revenue:

Waymo generates revenue via its subsidiaries Waymo One and Waymo Via. Here are the key insights about company income streams.

1. Waymo One:

Waymo One operates as a ride-hailing service, allowing users to book rides in autonomous vehicles through its app. Waymo One generates revenue by charging users for booking rides.

2. Waymo Via:

Waymo Via is another subsidiary of Waymo that generates revenue. Waymo Via is a package delivery service that uses autonomous trucks. Waymo Via generates revenue by charging its users for deliveries.

Read More: How to Buy Zipline Stock?

In addition to these two services, Waymo’s technology can also be utilized in other sectors such as public transportation and trucking, which have the potential to generate significant revenue in the future.

Key Competitors of Waymo:

Waymo is currently considered the leader in the self-driving car industry, but it has major competitors such as Tesla and GM’s Cruise.

1. Tesla Inc. (TSLA: NSD):

Tesla, a highly respected name in the automobile industry, has been actively developing technology for self-driving cars for several years and has already released the Autopilot feature. Tesla’s advanced artificial intelligence technology provides real-time updates that enable the cars to operate at a level exceeding other autonomous vehicle.

2. General Motors Company (GM: NYE):

Cruise is the self-driving unit of General Motors and also has fully operational robotaxis in several cities. Due to this innovation, its technology has great potential to compete against Waymo’s self-driving system.

3. Aurora (AUR: NSD):

Aurora is a startup company founded in 2017. It focuses on developing a self-driving platform that can be used in cars, trucks, and commercial vehicles. This means that it serves multiple industries, such as ride-hailing, logistics, and transportation. Aurora is working with car companies like Toyota to collect data from different cars. This helps them create a better self-driving system.

Conclusion:

Investing in Waymo stock directly may not be feasible for individual investors, as it is not publicly traded. However, investing in Alphabet and other partners can offer exposure to this promising industry. If you’re a retail investor, it’s a good idea to evaluate the risks and potential rewards of investing in Waymo and the autonomous driving industry before making any investment decisions.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.