HP Inc (HPQ: NYE) could be an under-the-radar beneficiary of the surging artificial intelligence (AI) market, according to analysts. Here’s why HPQ might be worth a closer look for investors.

Cheap Valuation and Solid Dividend:

HPQ currently trades at a price-to-earnings ratio of just 10.5, significantly lower than the tech sector average. This suggests the stock may be undervalued by the market. Additionally, HPQ offers a healthy 3.0% dividend yield, providing investors with a steady stream of income.

Stock Target Advisor’s Take on HP:

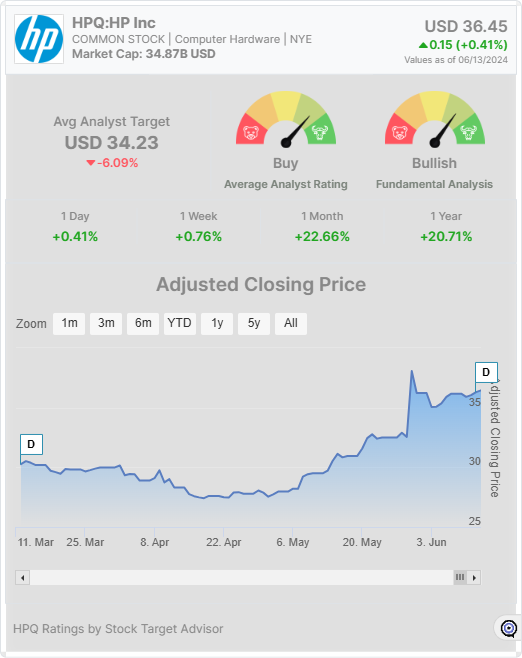

Stock Target Advisor has observed several positive signals for HPQ, including superior risk-adjusted returns and positive cash flow. The stock holds a buy rating, with a target price set at $34.78. Although there is a projected negative price change of -4.59% in the next 12 months, the positive free cash flow and return on assets could mean potential upside.

However, some caveats come with these positives. HPQ appears to be overpriced regarding cash flow and free cash flow, paired with its low revenue growth. This potential discrepancy needs careful evaluation by investors thinking of taking or increasing a position.

10 analysts cover HPQ with an average rating of Buy and an average target price of $34.23. Contrarily, the sector’s average analyst rating is a Strong Buy, whereas Stock Target Advisor’s is Slightly Bearish, indicating potentially heightened risk.

Conclusion:

HPQ offers a combination of value, dividends, and potential growth in the AI sector. However, investors should always conduct their own research before making any investment decisions.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.