Artificial intelligence (AI) has recently emerged as a dominant technology across several sectors, transforming how businesses operate and how individuals make decisions. In the financial world, AI is increasingly being leveraged to revolutionize investment strategies, providing investors with more consistent and reliable returns. Among these advancements, unbiased AI analysis stands out as a key factor in reshaping the future of investing, offering numerous benefits like objective decision-making, enhanced efficiency, and scalable solutions.

One platform at the forefront of this innovation is Stock Target Advisor, which utilizes advanced AI algorithms to analyze thousands of stocks, providing users with unbiased top picks and actionable insights.

3 Reasons Why AI Analysis is the Future of Investing:

Below are the top 3 reasons why AI unbiased stock analysis in the future of investing.

Before we dive in, we have a special offer! For a limited time, you can get 70% off Stock Target Advisor’s premium features.

1. Objective Decisions

One of the greatest challenges investors faces is overcoming emotional biases that cloud judgment and lead to suboptimal decisions. AI-driven analysis brings objectivity to the forefront, offering clear, data-based insights that enable more disciplined investment strategies.

Removes Emotional Biases:

In traditional investing, emotional decisions often lead to mistakes. Fear during market downturns and greed during bullish phases can cloud judgment, leading to poor choices. Unbiased AI, however, removes emotions from the equation entirely. AI algorithms make decisions based on data and statistical models, unaffected by the psychological factors that often trip up human investors.

Stock Target Advisor exemplifies this by providing objective stock recommendations based purely on data. Investors who rely on STA can make decisions free from emotional interference, which is crucial in achieving long-term investment success.

Data-Driven Insights:

The sheer volume of financial data available today can be overwhelming for even the most experienced investor. AI thrives in this environment, using advanced algorithms to analyze and interpret vast datasets, both historical and real-time. These data-driven insights allow AI systems to uncover trends, patterns, and risks that human investors might miss.

Rational Investment Choices:

By removing emotions and relying on data, AI-driven systems help investors make rational, consistent decisions. Whether you’re a long-term investor or a day trader, having access to a rational, data-backed strategy is essential for avoiding impulsive moves that can erode profits.

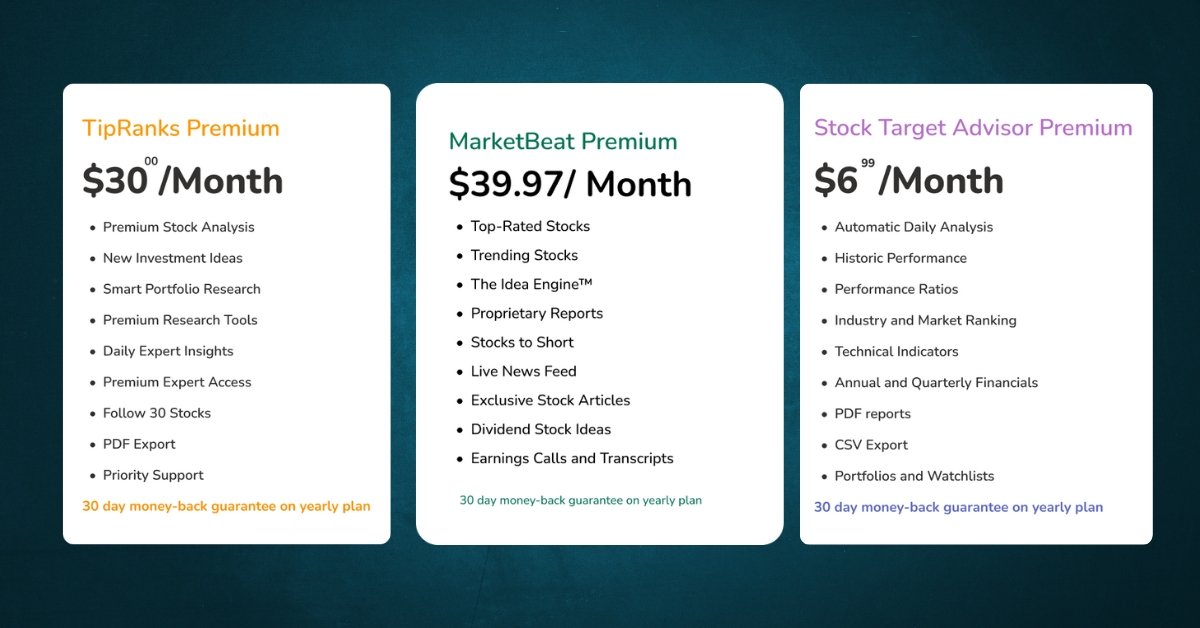

Read More: Stock Target Advisor vs Other Leading Platforms

2. Speed and Efficiency:

In today’s fast-paced financial markets, timing is everything. The ability to swiftly analyze data and react to changes is critical for maximizing returns and minimizing losses. AI systems offer unparalleled speed and efficiency, giving investors a significant edge over traditional methods.

Quick Market Reactions:

The stock market moves fast, and human investors often struggle to keep up with its rapid pace. AI systems, on the other hand, can react almost instantaneously to market shifts, analyzing data in real time and adjusting strategies accordingly.

For instance, if there’s sudden market volatility, an AI stock analysis platform like Stock Target Advisor can quickly process the new data and suggest actions that can help investors protect their portfolios. This speed gives AI-driven systems a distinct advantage over traditional methods that rely on manual analysis and decision-making.

Instant Insights:

One of the major advantages of AI in investing is the ability to deliver instant insights. Instead of spending hours poring over financial reports, investors can rely on AI to provide instant analysis of stocks, sectors, and economic conditions.

Real-Time Data Processing:

AI systems are continuously analyzing streams of real-time data. Whether it’s stock prices, earnings reports, or macroeconomic indicators, AI can process this information faster than any human analyst, ensuring that decisions are based on the latest available data.

Learn More: Top Features of STA Advanced Stock Screener

3. Scalable Solutions:

AI-driven investment tools are not limited by the size or complexity of portfolios. These systems can seamlessly scale to meet the needs of a wide range of investors, from individuals managing their personal investments to large institutional firms handling vast, multi-asset portfolios.

This flexibility allows AI platforms to grow alongside investors, offering value regardless of the scale or sophistication of their strategies.

Tailored to All Investors:

AI-powered platforms offer scalable solutions that cater to both novice and professional investors. Whether you’re managing a small personal portfolio or operating as part of an institutional investment team, AI-driven systems like Stock Target Advisor provide tailored insights to suit different investor profiles and risk tolerances.

Adaptive Strategies:

Markets are constantly evolving, and successful investing requires adaptability. AI systems excel at learning from past performance and adjusting their strategies based on new data. This ensures that investment strategies remain dynamic and relevant in the face of changing market conditions.

Suitable for All Asset Classes:

Another key advantage of AI-driven analysis is its versatility across different asset classes. Whether you’re interested in stocks, commodities, bonds, or cryptocurrencies, AI can analyze a wide range of assets and deliver actionable insights tailored to each.

Stock Target Advisor, for instance, primarily focuses on stocks, but its AI framework can be adapted to analyze other asset classes as well. This makes AI a powerful tool for diversified portfolios, helping investors manage risk and explore opportunities across multiple markets.

Conclusion:

Unbiased AI analysis is undeniably the future of investing. By eliminating emotional biases, offering data-driven insights, and providing scalable, adaptive solutions, AI empowers investors to make better decisions with greater confidence. Stock Target Advisor exemplifies this shift, offering users access to AI-powered stock analysis that delivers unbiased top picks and actionable insights.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.