In today’s fast-paced financial landscape, choosing the right stock market analysis platform can be a game-changer for investors. With so many options available, it can be challenging to find a platform that fits your specific needs.

In this feature article, we’ll dive deep into a head-to-head comparison of some of the leading stock market analysis platforms: Stock Target Advisor Platinum, TipRanks, MarketBeat, and Seeking Alpha Premium. By the end, you’ll have a clearer picture of which service offers the most value based on your investment style, goals, and budget.

1. AI-Powered Stock Analysis and Ratings:

Choosing a platform with robust stock analysis and reliable ratings is crucial for making informed investment decisions. Let’s compare how Stock Target Advisor, TipRanks, MarketBeat, and Seeking Alpha Premium stack up in this category.

Stock Target Advisor:

Stock Target Advisor stands out in this category with its AI-powered stock analysis. The platform leverages advanced AI algorithms to provide unbiased recommendations, helping investors identify top-performing stocks based on comprehensive data analysis.

Unlike many platforms that may have biases due to human analysts’ inclinations, STA ensures that the stock picks are driven purely by data. This is particularly beneficial for investors who want to avoid emotional trading and focus on data-backed decisions.

Tip Ranks:

On the other hand, TipRanks takes a different approach by aggregating analyst ratings and ranking these analysts based on their historical performance. This gives users a “Smart Score” for each stock, reflecting its potential upside based on top-performing analysts’ opinions. This feature is particularly useful for investors who prefer human analysis and want to see which experts have been most accurate over time.

Market Beat:

MarketBeat focuses more on delivering timely information, such as analyst upgrades and downgrades, and offers a consolidated view of consensus ratings. This makes it an excellent choice for investors who are looking for quick, actionable insights to make short-term decisions. However, MarketBeat doesn’t provide the same level of AI integration or depth in its stock ratings as STA or TipRanks.

Seeking Alpha Premium:

Finally, Seeking Alpha Premium provides extensive financial data and community-driven analysis. Users get access to a wealth of articles and opinions from a broad range of financial experts, which can be valuable for those who appreciate diverse perspectives. However, this community-driven approach can sometimes lead to information overload and might require more effort to filter out valuable insights.

2. Stock Screeners and Research Tools:

Finding the right stock often requires powerful screening tools and comprehensive research capabilities. Here’s how the top platforms compare in offering investors the insights they need to make informed decisions.

Stock Target Advisor:

When it comes to stock screeners and research tools, Stock Target Advisor shines with its next-generation stock screener. This tool allows investors to customize their search based on various criteria, such as security type, exchange, market cap, dividend yield, and more. The flexibility of STA’s stock screener makes it particularly powerful, as it caters to specific investment strategies, whether you’re a dividend investor, a growth seeker, or looking for undervalued stocks.

Tip Ranks:

TipRanks offers a more basic screening capability that primarily focuses on top analyst ratings and price targets. While this is useful for quick checks, it doesn’t provide the depth of customization that STA offers. The primary advantage of TipRanks in this area is its simplicity, which might appeal to beginners or those looking for straightforward, easy-to-digest information.

Read More: TipRanks Review 2024

Market Beat:

MarketBeat offers a range of research tools, including insider trading data, institutional ownership, and short interest reports, which are great for gauging market sentiment and understanding stock movements. Their stock screener, however, lacks the granularity and customization options found in STA.

If you’re looking to make decisions based on broader market trends and insider activities, MarketBeat might suit your needs, but it may not suffice for detailed, criteria-based stock filtering.

Seeking Alpha Premium:

Seeking Alpha Premium excels with its comprehensive screeners that allow detailed filtering based on a wide array of financial metrics. The platform’s strength lies in its ability to offer deep data coverage and community insights, but like MarketBeat, it lacks the easy customization and automation that STA provides.

For investors who enjoy digging deep into financial metrics and prefer a DIY approach to stock analysis, Seeking Alpha Premium offers a valuable resource.

3. Pricing and Subscription Models:

When evaluating stock analysis platforms, it’s crucial to consider the value offered relative to their cost. Each platform has different pricing strategies, catering to various types of investors and budgets.

Stock Target Advisor:

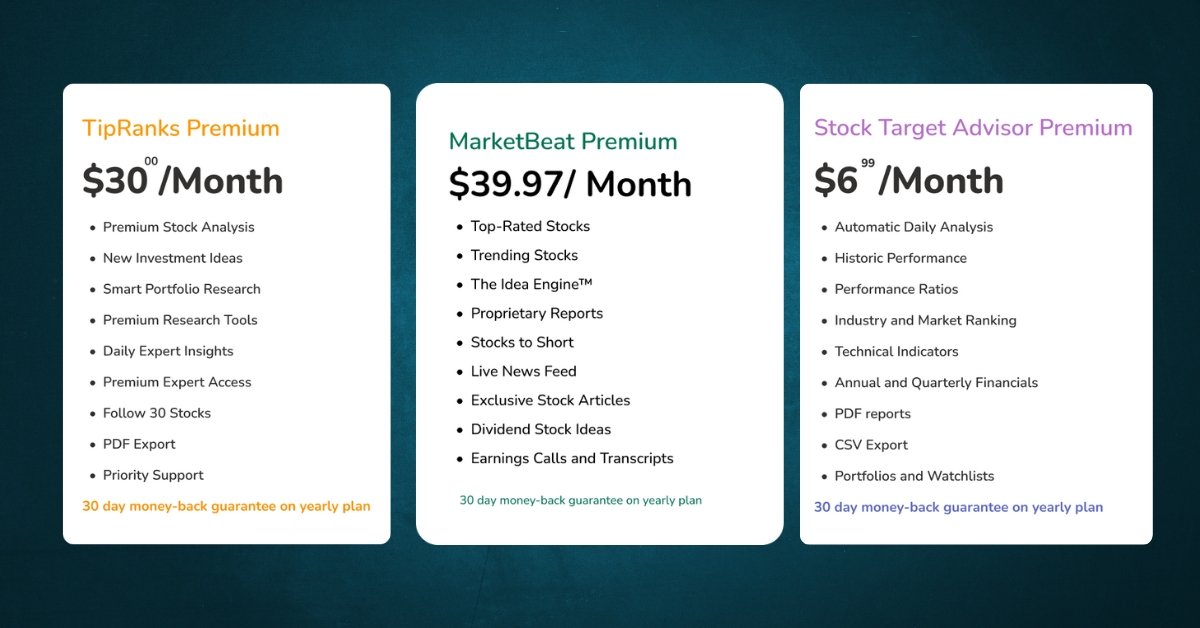

Pricing is always a significant factor when choosing a stock analysis platform. Stock Target Advisor Platinum offers one of the most affordable premium services at just $7 per month.

Despite its low price, STA doesn’t skimp on features, providing comprehensive tools and analysis capabilities that rival even the more expensive platforms. This makes it an excellent choice for both beginners and experienced investors looking for a cost-effective solution.

Tip Ranks:

TipRanks offers a tiered subscription model, with a basic free membership and a premium version priced at $30 per month. The premium version provides access to advanced research tools, real-time alerts, and top analysts’ portfolios.

This price point is reasonable, considering the quality of the data and analysis provided, but it is more expensive than STA, which offers a similar level of insight at a much lower cost.

Market Beat:

MarketBeat also has a tiered pricing structure, with a free basic membership and premium plans starting at $39.97 per month. The premium plans offer more advanced research tools and data sets, making them suitable for more experienced investors who need in-depth market analysis. However, at nearly six times the cost of STA, MarketBeat may not provide enough additional value to justify the higher price, especially for investors on a budget.

Read More: MarketBeat Review 2024

Seeking Alpha Premium:

Seeking Alpha Premium is the most expensive of the bunch with an annual subscription fee of $239. This platform offers a vast array of data, articles, and expert analysis, which can be incredibly valuable for those who want deep dives into financial topics. However, the higher price point may be a barrier for many, especially when comparable insights and tools can be found on less expensive platforms like STA.

Conclusion:

Choosing the right stock market analysis platform depends on your individual needs, investment goals, and budget. Stock Target Advisor Platinum excels in providing a robust, AI-powered platform with a next-generation stock screener, customizable real-time alerts, and detailed automated research reports. Its affordable pricing makes it an attractive option for both novice and experienced investors who want comprehensive tools without breaking the bank.

While TipRanks and MarketBeat offer valuable features, such as credible analyst rankings and timely updates, they come at a higher cost and may lack the depth of customization and AI-driven insights found in STA. Seeking Alpha Premium provides extensive data and community-driven analysis but at a significantly higher price, making it a better fit for those who prioritize a wide range of expert opinions and have a larger budget.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.