Launching the Extended Range Model 3 in China

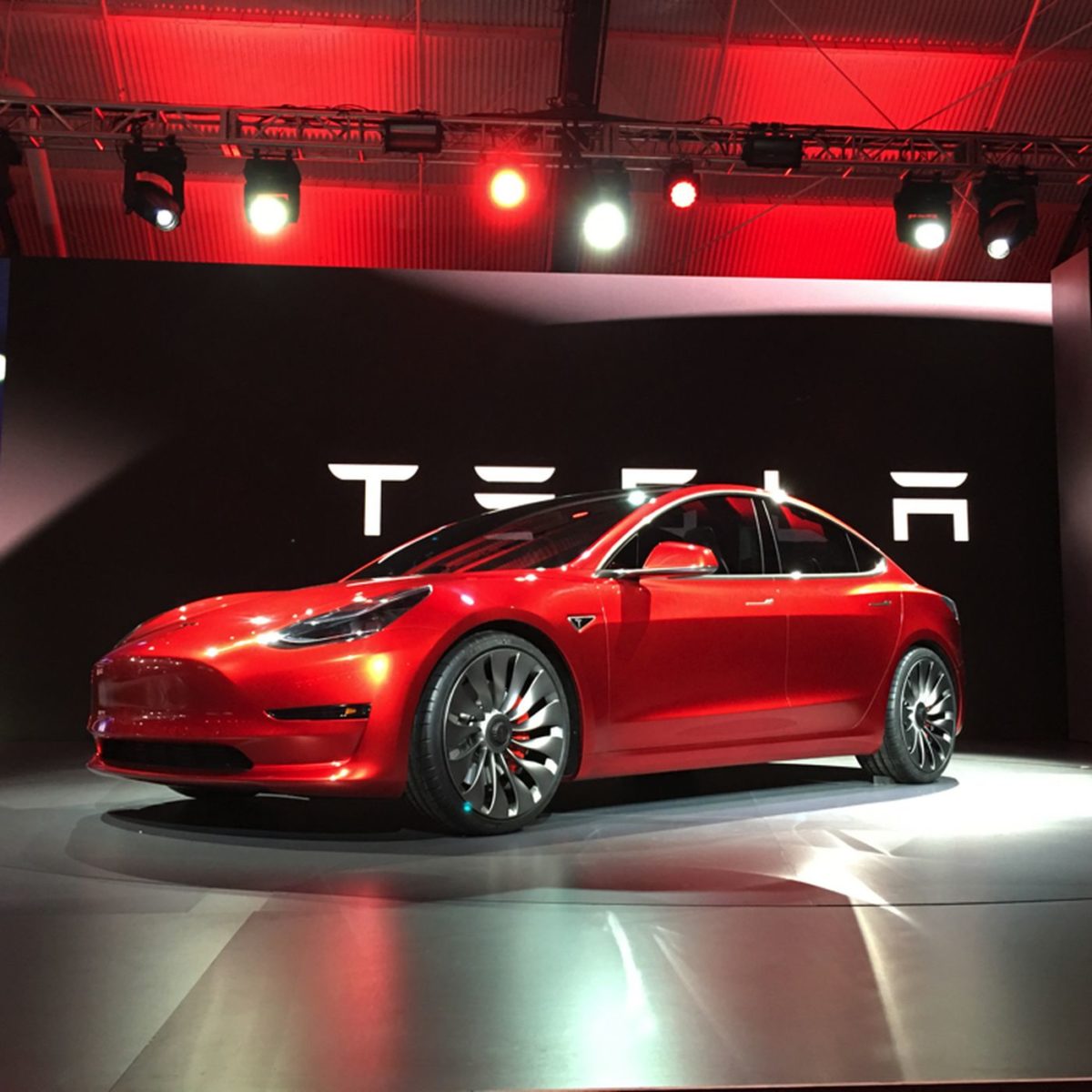

Tesla has unveiled a newly restyled version of its highly popular Model 3, proudly produced in China, and boasting an extended driving range. This milestone marks the first instance of Tesla launching a new model in China before introducing it to the United States. In this article, we’ll delve into the details of Tesla’s latest move and its significance in the electric vehicle (EV) market.

Keeping Tesla’s Technology in the Lead

Tesla’s decision to launch an updated Model 3 in China underscores the country’s importance in the global EV landscape. China has rapidly emerged as the world’s largest EV market, thanks to government incentives, environmental awareness, and a growing middle class increasingly interested in sustainable transportation.

The introduction of an extended range Model 3 signals Tesla’s commitment to catering to the specific needs and preferences of the Chinese market. Longer range EVs are particularly attractive to Chinese consumers, as they alleviate range anxiety concerns and make electric vehicles a more viable option for long-distance travel.

The New Model 3

The updated Model 3 features a range extension, offering consumers even more miles per charge. Range is a critical factor for EV adoption, and Tesla’s focus on improving it aligns with the demands of the Chinese market. With this enhancement, Tesla is poised to attract a wider audience, from daily commuters to road-tripping enthusiasts.

China Production Advantage

Tesla’s production facility in Shanghai has proven to be a strategic asset. By manufacturing vehicles locally, Tesla can reduce costs, streamline production processes, and respond more swiftly to market demands. This localized approach has not only allowed Tesla to serve the Chinese market efficiently but also provides opportunities for innovation and adaptation.

The Made-in-China Model 3 underscores Tesla’s commitment to sustainable practices. By manufacturing vehicles in China, Tesla can reduce its carbon footprint associated with shipping and logistics. Additionally, the use of local suppliers further promotes the development of China’s EV ecosystem.

Global Implications

Tesla’s move to launch a new Model 3 variant in China carries broader implications for the global automotive industry. It highlights China’s pivotal role as a trendsetter and frontrunner in the EV sector. Other automakers are likely to follow suit, tailoring their EV offerings to meet Chinese consumers’ preferences for extended range, cutting-edge technology, and sustainable manufacturing.

Tesla’s decision to prioritize China also reflects the growing competition in the EV market. As established automakers and new entrants vie for market share, staying ahead in terms of innovation and customer-centric offerings is vital. Tesla’s willingness to adapt and cater to the Chinese market exemplifies its agility in a rapidly evolving industry.

Impact of New Model 3

Tesla’s launch of the restyled Model 3 with an extended driving range in China signifies a remarkable step in the evolution of the global electric vehicle market. China’s prominence as a key player in the EV sector is underscored by Tesla’s strategic decision to debut the new model there. The move not only positions Tesla as a leader in innovation and adaptation but also recognizes the unique preferences and requirements of Chinese consumers.

As Tesla continues to expand its presence in China and the broader global market, it is poised to further shape the future of electric mobility, setting new standards for range, sustainability, and customer satisfaction. This launch is not just a significant moment for Tesla; it’s a milestone for the entire EV industry as it marches towards a more sustainable and electrified future.

TSLA Stock Forecast & Analysis

Analyst Projections

According to a consensus of 31 financial analysts, the average target price for Tesla Inc’s stock is estimated to reach USD 231.85 over the next 12 months. This figure represents the collective viewpoint of experts who have conducted extensive analysis of Tesla’s financials, market conditions, and growth prospects. It’s essential to note that target prices are forward-looking and provide investors with an idea of where the stock may be headed.

Tesla Inc enjoys an average analyst rating of “Buy.” This indicates a consensus among analysts that the company’s stock is currently undervalued or possesses strong growth potential. The “Buy” rating reflects optimism regarding Tesla’s future prospects, potentially driven by factors such as increasing EV adoption, expanding production capacity, and advancements in autonomous driving technology.

Market Signals and Stock Target Advisor Analysis

Stock Target Advisor has performed its own analysis of Tesla Inc’s stock, categorizing it as “Slightly Bullish.” This assessment is derived from a balance of 9 positive signals and 5 negative signals related to various aspects of the company’s financial health and market performance.

The positive signals may encompass factors such as robust revenue growth, increased vehicle deliveries, strong demand for Tesla’s products, and the company’s expansion into new markets. Conversely, the negative signals could include concerns about competition, supply chain challenges, and regulatory changes affecting the EV industry.

Recent Performance and Price Trends

As of the last closing, Tesla Inc’s stock was trading at USD 258.08. Over the past week, the stock price has exhibited notable positive momentum, surging by +12.19%. This short-term performance may have been influenced by a variety of factors, including positive news, investor sentiment, and broader market trends. Over the past month, Tesla’s stock price has experienced a decline of -3.50%, and over the last year, it has dipped by -6.36%. These figures reflect the dynamic nature of the stock market and the multitude of factors that can impact a company’s valuation over time.