Tesla Inc (TSLA) has unveiled a groundbreaking AI roadmap that promises to revolutionize the electric vehicle (EV) industry, further bolstering its technological edge. The company’s bold AI strategy emphasizes advancements in autonomous driving, energy optimization, and production efficiency, positioning Tesla as a frontrunner in integrating artificial intelligence across its operations.

Market Reaction on This News:

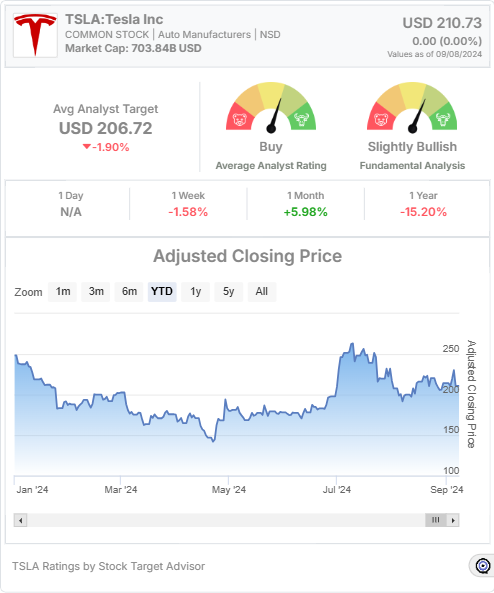

Tesla’s stock witnessed heightened activity following the release of its new AI roadmap. Despite some market volatility, Tesla shares are currently trading at $210.73, reflecting an 11.89% rise over the past month, although they have seen a slight decline of 3.38% over the last week. Investors are closely monitoring how these AI advancements could influence the company’s long-term growth and overall market performance. Tesla’s stock has historically exhibited high volatility, a characteristic that has been both a boon and a risk for its investors.

Stock Target Advisor’s Analysis on Tesla:

Stock Target Advisor’s analysis of Tesla indicates a Slightly Bullish stance, bolstered by 10 positive and 6 negative signals. Key strengths for Tesla include superior returns on equity, capital utilization, and revenue growth, all of which are in the top quartile compared to its industry peers.

Additionally, Tesla boasts a robust cash flow and top-tier earnings growth over the past five years. However, Tesla’s stock remains highly volatile and is perceived as overpriced in terms of earnings, book value, and cash flow. The stock is also highly leveraged, a factor that could impact investor sentiment in the face of rising market uncertainties.

Tesla’s 12-month target price is pegged at $206.72 by analysts, with Stock Target Advisor projecting a slight price decline of 5.68%. Despite this cautious outlook, many analysts still maintain a “Buy” rating on the stock, underscoring the market’s faith in Tesla’s long-term potential, particularly with the integration of cutting-edge AI technologies.

Conclusion:

Tesla’s commitment to advancing artificial intelligence through its new roadmap has solidified its position as a key player in both the EV and AI spaces. Stock Target Advisor’s “Slightly Bullish” rating reflects the cautious optimism surrounding Tesla, as the company’s AI advancements are expected to drive significant growth in the years ahead.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.