Uber Technologies Inc (UBER) announced its financial results for the second quarter of 2024, showcasing impressive growth and profitability. With significant increases in gross bookings, revenue, and net income, the company’s performance continues to reflect its robust market position.

Key Insights from Uber Technologies’ Q2 Reports:

Below are the key findings from Uber Technologies Q2 Report:

- Gross Bookings Growth: Grew by 19% year-over-year (YoY) to $40.0 billion. Increased by 21% on a constant currency basis. Mobility gross bookings rose by 23% YoY.

- Revenue Growth: Reported revenue growth of 16% YoY, reaching $10.7 billion.

- Adjusted EBITDA: Surged by 71% YoY to $1.6 billion, highlighting operational efficiency.

- Operational Cash Flow: Uber’s operational cash flow was $1.8 billion. Free cash flow reached $1.7 billion.

Management Discussion and Analysis:

CEO Dara Khosrowshahi emphasized Uber’s continued strong performance, noting the platform’s record profitability and growth. CFO Prashanth Mahendra-Rajah highlighted the company’s durable growth and significant cash flow generation. Uber’s revenue grew by 16% YoY to $10.7 billion, driven by a 21% increase in gross bookings. Mobility and delivery revenues grew by 25% and 8% YoY, respectively.

Uber’s income from operations was $796 million, a substantial increase from $326 million in Q2 2023. The company’s net income attributable to Uber Technologies was $1.0 billion, which includes a $333 million benefit from net unrealized gains related to the revaluation of Uber’s equity investments. These figures demonstrate Uber’s ability to manage costs effectively while driving revenue growth.

Stock Target Advisor’s Analysis on Uber Technologies:

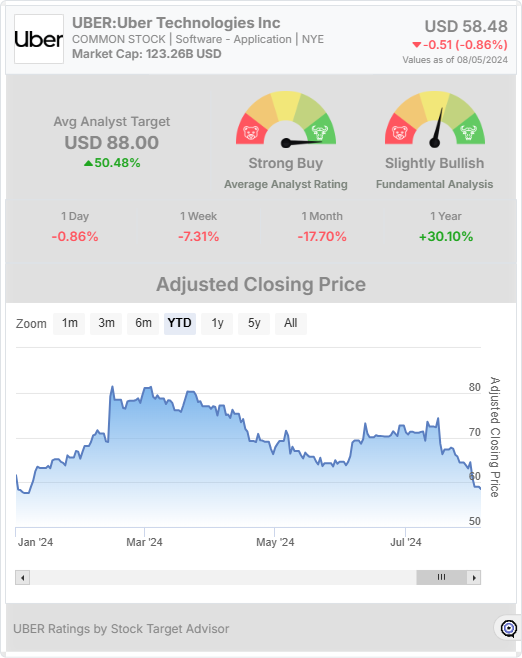

According to Stock Target Advisor, Uber Technologies has a slightly bullish outlook based on eight positive signals and six negative signals. The average analyst target price for Uber over the next 12 months is USD 88.00, with a strong buy rating. Uber’s stock price was USD 58.48 at the last closing, reflecting a 30.10% increase over the past year despite recent volatility.

Conclusion:

Uber Technologies’ Q2 2024 results highlight the company’s strong financial performance, operational efficiency, and strategic growth initiatives. The company’s robust revenue growth, increased profitability, and effective cost management underscore its market leadership. Despite some challenges, such as high volatility and leverage, Uber’s overall outlook remains positive.

Muzzammil is a content writer at Stock Target Advisor. He has been writing stock news and analysis at Stock Target Advisor since 2023 and has worked in the financial domain in various roles since 2020. He has previously worked on an equity research firm that analyzed companies listed on the stock markets in the U.S. and Canada and performed fundamental and qualitative analyses of management strength, business strategy, and product/services forecast as indicated by major brokers covering the stock.